Africa is a continent with a rapidly growing economy and a young population, which makes it an attractive market for startups and investors. What can the YCombinator (YC) investments tell us about the business innovations on the continent?

As at the end of 2024, there have been 122 companies serving the African market, according to YC Directory. These are companies either based on the continent or elsewhere, but focusing on the African market. The companies demonstrate a significant amount of business innovation, particularly in emerging markets. This innovation is being driven by a number of factors, including the need for greater financial inclusion, the growing demand for B2B solutions, the changing needs of consumers in emerging markets, and the increasing adoption of technology.

For those who might not know, YC is a renowned startup accelerator, based in California, USA. The overall goal of YC is to help startups really take off, by providing seed funding, guidance, and networking opportunities. YC only accepts between 1.5% to 2% of applications, and has backed approximately 5000 startups since its inception in 2005, including giants like Airbnb, Dropbox, and Stripe.

Trend of YC’s Investment into Africa

YC’s first investment into an African startup took place in 2012 into Wave, a mobile money app from Senegal. Following this, YC began ramping up its investment into Africa, with a record of 37 investments in 2022. However, we see a huge decline in investments, falling from 37 to 8 in 2023, and only 7 in 2024.

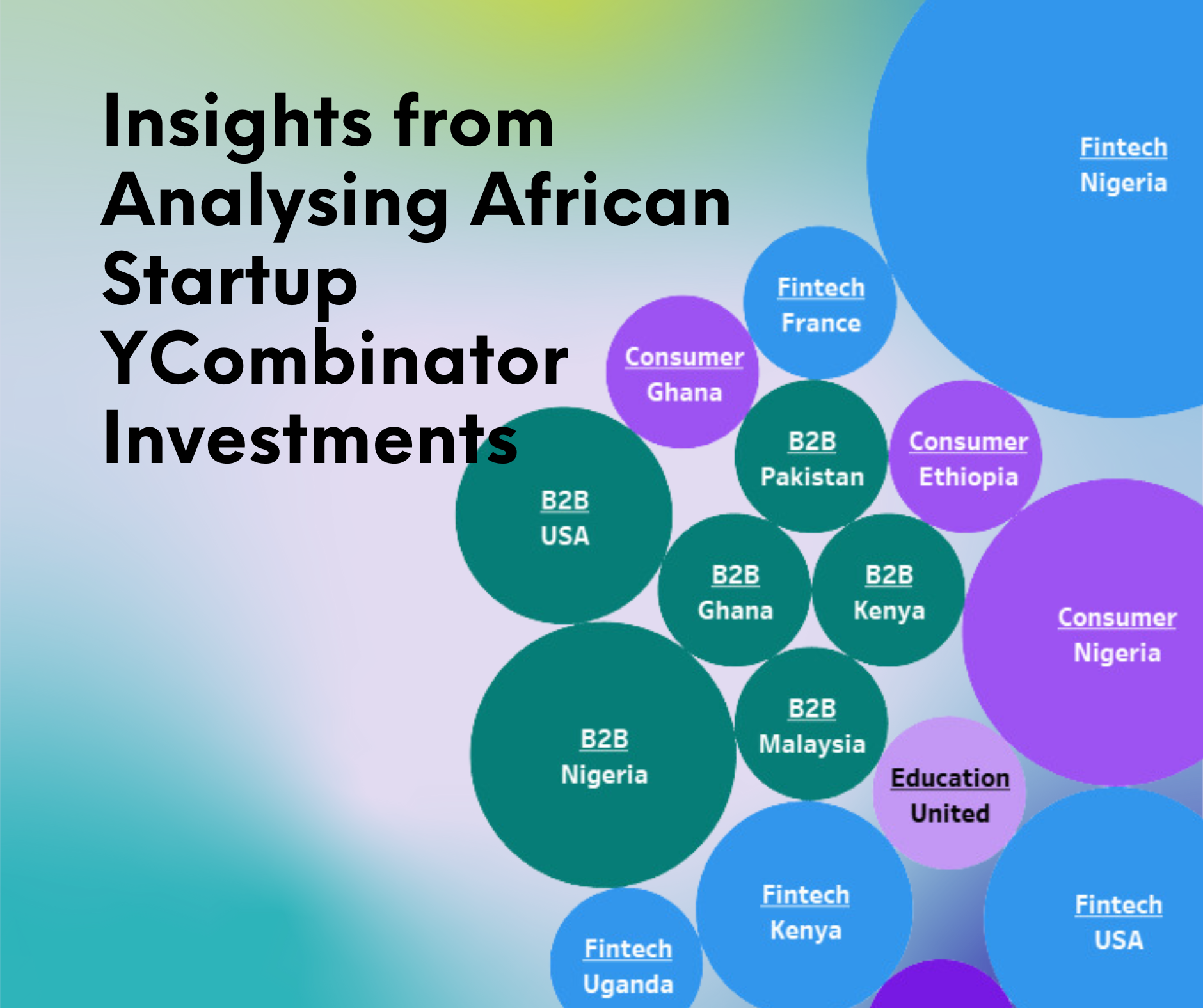

Many of these companies are based in Nigeria, specifically in the city of Lagos. North America, particularly the United States, is the second most represented region on the list. Other regions represented in the list include Europe, the Middle East, and Southeast Asia.

Business innovations

The list of 122 companies reveals several key areas of business innovation, mainly:

- Fintech: The sources highlight a wave of Fintech innovation in Africa, driven by the need for greater financial inclusion and access to services. 55 companies out of the 122 are developing solutions for payments, credit and lending, banking and exchange, and asset management. This focus on Fintech is likely influenced by the large and young population in Africa, as well as the increasing adoption of mobile technology.

- B2B Solutions: 34 companies are creating B2B solutions tailored to the needs of businesses in Africa. This includes companies focusing on supply chain and logistics, sales, productivity, and infrastructure. These innovations are addressing challenges related to transportation, distribution, access to markets, and business operations in the region.

- Meeting Consumer Demands in Emerging Markets: The sources also illustrate how companies are adapting their products and services to meet the unique demands of consumers in emerging markets. For example, companies like Heyfood and Chow Central Inc. are bringing food delivery services to Africa, while companies like Tizeti are providing internet services. This focus of 15 companies on consumer-oriented solutions reflects the growing purchasing power and changing lifestyles of consumers in these regions.

- Other industries represented in the list include Healthcare, Education, Real Estate and Construction, and Industrials.

Many of the companies on the list are focusing on specific niches within their respective industries. For example, Fingo Africa is targeting Africa’s youth with its neobank, while Grey is catering to remote workers and digital nomads with its banking services. This niche focus allows companies to tailor their products and services to specific customer segments and gain a competitive advantage.

The list also highlights the growing importance of technology in all industries. Across all industries, the sources emphasize the use of technology as a key driver of innovation. Companies are using mobile technology, artificial intelligence, and data analytics to develop solutions that are efficient, scalable, and tailored to the needs of their target markets.

I naturally have no insights into YC’s investment strategy, but in looking at the list, I was a bit surprised that there are not more agriculture, energy, or climate-focused businesses, rapid scaling and global reach seems to be the focus. Maybe these might be perceived as riskier investments as they are prone to unpredictable weather patterns, regulatory uncertainties, and longer investment horizons. Also some sectors, like climate tech, might still be in their early stages of development in the African context.

You can find the full list of the 122 companies here.